The HBM War: SK Hynix Won the Battle, Samsung Plans to Win the War

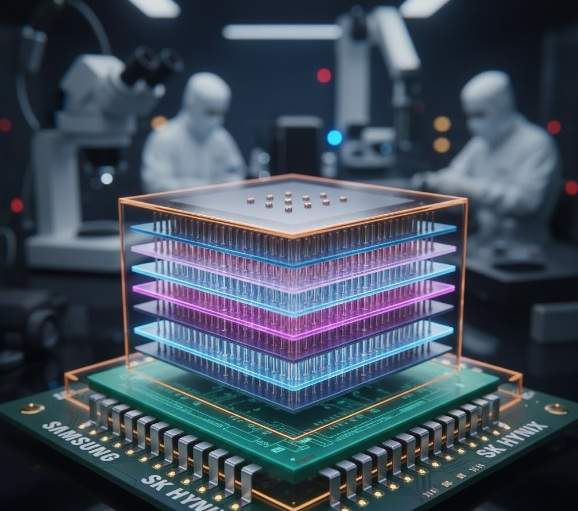

The global AI revolution runs on High Bandwidth Memory (HBM). In the critical battle for HBM3E, SK Hynix has secured a decisive—and, to many, surprising—lead, appearing to dethrone the long-reigning champion, Samsung.

However, from a perspective on the ground in Seoul, this narrative is incomplete.

While SK Hynix has clearly won the current round, local analysts see this as just the first battle in a much longer war. What US-based reports often miss is the strategic depth of Samsung’s counter-offensive. This isn’t the story of a permanent fall; it’s the story of a “wartime” corporate response and a high-stakes gamble to win the next war.

Here is our analysis of the miscalculations that led to this temporary lag, and the formidable strategy Samsung is already deploying to reclaim the throne.

The Core of the Crisis: How SK Hynix Secured the Nvidia Crown

The HBM market has one customer that matters above all others: Nvidia. The company that controls over 80% of the AI accelerator market effectively dictates the terms. In 2024, SK Hynix achieved a near-total victory by becoming the exclusive top-tier supplier of HBM3 and the next-generation HBM3E to Nvidia, locking in market dominance early.

Samsung, the world’s largest memory manufacturer, was conspicuously late. The reason? A critical divergence in manufacturing technology.

- SK Hynix’s Master Stroke (MR-MUF): SK Hynix perfected its Mass Reflow Molded Underfill (MR-MUF) stacking technology. This method proved superior at managing heat dissipation and improving production yields for the complex, vertically-stacked 12-layer HBM chips.

- Samsung’s Costly Stumble (NCF): Samsung, by contrast, stuck with its more established Non-Conductive Film (NCF) method. According to reports from analysts and industry sources in Seoul, Samsung bet that NCF would be “good enough.” It was not. This method led to significant yield rate and quality issues that failed to meet Nvidia’s stringent, time-sensitive qualification tests for its flagship H200 and Blackwell-series GPUs.

The result was a market share collapse. In a matter of quarters, SK Hynix captured an estimated 60-70% of the entire HBM market, leaving Samsung to fight for the remainder.

A View from Seoul: The “Emergency” Inside Samsung Electronics

What US media reports as a “lag,” local Korean media has been describing as an internal crisis. From a perspective in Seoul, the reaction inside Samsung Electronics has been nothing short of a “wartime” footing.

In an move widely described as “unprecedented” by Korean financial news, Samsung leadership reassigned over 2,000 engineers from its other business units—including its highly profitable DRAM and NAND flash divisions—directly to the HBM production and yield teams in Pyeongtaek.

This is not a standard corporate shuffle. This is an all-hands-on-deck emergency response. It signals the immense pressure on Samsung’s new semiconductor (DS) division leadership to fix a problem that is seen as a matter of national and corporate pride, not just quarterly revenue.

Analysts in Yeouido (Seoul’s Wall Street) have been fixated on this internal response, understanding that Samsung’s chaebol (conglomerate) culture is now fully mobilized to solve this problem, viewing it as an existential challenge to its identity as the world’s top memory chipmaker.

Samsung’s Two-Pronged Counter-Offensive

Samsung is down, but it is far from out. From our vantage point, the company is executing a classic “pincer” movement: securing alternate customers to stop the bleeding while simultaneously attempting to leapfrog SK Hynix entirely.

Prong 1: Diversifying the Customer Base (The AMD Win)

While the Nvidia qualification for HBM3E stalled, Samsung’s sales teams pivoted hard. They successfully secured a major deal to supply their 12-layer HBM3E chips to AMD for its new MI-series AI accelerators.

This was a crucial rebound. It provides Samsung with a vital, high-volume revenue stream, proves its 12-layer HBM3E is viable for the market, and—most importantly—gives it a strategic hedge against total reliance on Nvidia.

Prong 2: The HBM4 Leapfrog Gambit

This is Samsung’s ultimate plan: make the HBM3E battle irrelevant by winning the HBM4 race.

This is a high-risk, high-reward strategy. What analysts in Korea are noting is that Samsung is betting on more advanced, next-generation technologies for its HBM4 product, aiming to create a technically superior chip that Nvidia and other clients cannot ignore.

The “insider” technical specifications being discussed include:

- A more advanced 1c DRAM process (a generation ahead).

- A 4-nanometer logic base die, which would be a significant performance and efficiency jump.

The goal is to hit 11 Gbps speeds per pin, a spec designed to outperform the 9-10 Gbps expected from SK Hynix’s first HBM4 offerings. If Samsung can pull this off, it could leapfrog from second place directly back to first, forcing SK Hynix to play catch-up.

The Nvidia Alliance: Is the “Lag” Already Forgiven?

Despite the HBM3E stumble, the long-term relationship between Samsung and Nvidia is simply too big to fail. Nvidia cannot, and will not, allow itself to be single-sourced by SK Hynix indefinitely.

The most critical development, which confirms this “insider” view, came in late 2025. Samsung and Nvidia announced a new “AI Megafactory” collaboration.

Buried within the press releases for this partnership was the critical phrase investors had been waiting for: “key supply collaboration for HBM3E and HBM4.”

This is the signal. It strongly implies that Samsung is finally passing or has passed qualification for its 12-layer HBM3E, or, more likely, that Nvidia is locking in Samsung as a vital second source for the all-important HBM4 generation. This de-risks Nvidia’s supply chain and restores market competition.

Conclusion: A Tale of Two Giants

From the perspective in Seoul, the HBM story is a fascinating tale of two rivals. SK Hynix won the battle of HBM3E through superior execution and a smarter, focused technology bet (MR-MUF). Samsung, the incumbent giant, was caught flat-footed, revealing a rare vulnerability.

This HBM lag was a costly, embarrassing lesson for Samsung. But its response—the massive internal reorganization, the strategic AMD pivot, and the aggressive HBM4 leapfrog strategy—shows the giant is now fully awake.

The HBM war is far from over. Thanks to this intense domestic rivalry, it has just entered its next, more intense, phase.

Hi, I’m [jeybee]. As a long-time resident of Seoul, I’m passionate about uncovering the authentic, everyday magic of Korea. This blog is my way of sharing my favorite spots, tips, and cultural insights with you, beyond the usual tourist traps.