K-Battery: Beyond EVs, A Defense Game-Changer

When Western financial media covers South Korea’s “Big 3” battery makers—LG Energy Solution, Samsung SDI, and SK On—the narrative is singular: a high-stakes competition with China’s CATL for dominance in the global electric vehicle market. This is an important story, but it’s not the only one.

From a perspective in Seoul, this obsessive focus on the consumer EV race misses a parallel, and arguably more strategic, high-margin pivot. K-Battery technology is quietly being integrated into K-Defense’s multi-billion dollar export portfolio. This is not a lucky coincidence; it’s a deliberate national strategy to create an integrated tech-defense ecosystem, securing domestic supply chains and forging a powerful new differentiator on the global arms market.

The ‘Seoul Insider’ View: Beyond the EV vs. CATL Narrative

The dominant Western narrative is simple. The global battery market is a race for EV supremacy. What analysts in Korea are noting, however, is a second, more calculated strategy unfolding in tandem. This strategy is orchestrated by the government’s Defense Acquisition Program Administration (DAPA), which is actively fostering partnerships between these battery chaebols and defense giants like Hanwha and Hyundai Rotem.

The goal is twofold. First, to ensure supply chain security for critical defense components, insulating South Korea’s military from foreign suppliers. Second, to leverage its world-class battery technology as a core selling point for its next generation of submarines, tanks, and advanced aircraft. This creates an integrated export package that few competitors can match.

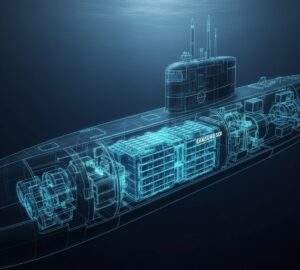

The Silent Service: Samsung SDI Powers the KSS-III Submarine

The most significant and operationally proven example of this pivot is submerged in the seas off the Korean peninsula. A common misconception, even among defense analysts, is that LGES, as the largest battery maker, powers Korea’s new submarines.

This is incorrect. According to local Korean shipbuilding reports and naval specifications, it is Samsung SDI that provides the game-changing lithium-ion batteries for the new KSS-III Batch-II (Dosan Ahn Changho-class) submarines.

This is a revolution, not an evolution, for non-nuclear submarine technology. The legacy lead-acid batteries that power the world’s diesel-electric fleets are a critical vulnerability. They offer limited endurance, require frequent and noisy snorkeling to run diesel generators, and have a long recharge time.

Samsung SDI’s Li-ion battery technology shatters these limitations. Naval analysts in Seoul report that this system provides two to three times the submerged endurance, allowing the submarine to remain “on station” and undetected for far longer. Furthermore, it has a lower acoustic signature and can be recharged significantly faster, dramatically increasing the vessel’s operational tempo.

The Export Angle: A Key Differentiator for Hanwha Ocean

This isn’t just a domestic upgrade; it’s a core component of Hanwha Ocean’s (formerly DSME) global export strategy. When Hanwha bids for major contracts, such as the lucrative Canadian submarine replacement project (CPSP), this proven, operational Li-ion battery system is a primary selling point.

From a Seoul perspective, this is a direct competitive broadside against European rivals. German competitors like ThyssenKrupp are still largely offering proven-but-older air-independent propulsion (AIP) with lead-acid batteries. While France’s Naval Group offers Li-ion, its technology is seen as less operationally proven at the scale of the KSS-III’s system. Hanwha is selling a “battle-tested” (in this case, operationally deployed) next-generation technology, today.

The Air & Drone Front: LG Energy Solution & Hanwha Aerospace

While Samsung SDI dominates beneath the waves, LG Energy Solution is focused on the skies, codified in its formal Memorandum of Understanding (MoU) with Hanwha Aerospace for developing “special-purpose batteries.”

Powering Future Drones and UAMs (Urban Air Mobility)

Hanwha Aerospace is a key player in Korea’s “UAM Team,” a national consortium to develop Urban Air Mobility (UAM), or “flying taxis.” LGES is developing the high-density, lightweight, and extremely reliable battery packs for these systems.

The dual-use application is clear. The same technology required to safely fly civilians over a city is directly applicable to the military’s next generation of systems. This R&D will power:

- Military eVTOL (electric vertical take-off and landing): For rapid, quiet insertion of special forces or medical evacuation.

- Long-Endurance Reconnaissance Drones: Where battery density and low weight are paramount for extending time-over-target.

Securing the Grid: Military-Grade Energy Storage Systems (ESS)

This partnership also has a critical, if less glamorous, application: Energy Storage Systems (ESS). Modern warfare runs on data and electricity. Command centers, advanced radar sites (like the L-SAM missile defense system), and air-defense batteries require a secure, hardened, and uninterrupted power supply.

LGES, already a global leader in grid-scale ESS, is partnering with Hanwha Solutions (Qcells) to position itself as the key provider of these military-grade ESS solutions. This is about building resilient infrastructure, a component of national defense often overlooked by platform-focused analysis.

The Solid-State Armor: SK On, Samsung, and the Next-Gen Land Force

The final piece of the puzzle is the future of land warfare. In Seoul, the race for solid-state batteries (SSBs) is watched not for its potential to create longer-range EVs, but for its critical defense applications.

SSBs are the holy grail for armored vehicles for one simple reason: survivability. Conventional lithium-ion batteries use a flammable liquid electrolyte. If a tank’s battery pack is pierced by a projectile, the resulting fire can be catastrophic for the crew. Solid-state batteries are non-flammable.

For a tank commander, this is a non-negotiable advantage. Beyond safety, SSBs offer higher energy density for silent “silent watch” operations (powering sensors without running the engine) and better performance in the extreme hot and cold temperatures common on the Korean peninsula or in export markets.

Enabling the K3 Tank and Robotic Warfare

This technology is the key enabler for the next generation of K-Defense land systems.

- K3 Main Battle Tank: The successor to the K2 Black Panther will require a powerful hybrid-electric drive to manage its massive sensor and active-protection-system power load. SSBs are the solution.

- Hyundai Rotem’s Unmanned Ground Vehicles (UGVs): These robotic platforms, designed for reconnaissance and fire support, demand the power density and safety that only SSBs can provide.

What analysts in Korea are noting is that the recent launch of pilot production lines for SSBs by both Samsung SDI and SK On is not a coincidence. DAPA’s clear future-force requirements are directly influencing the R&D priorities of the K-Battery giants.

Analyst’s Take: An Integrated Tech-Defense Ecosystem

To view this as three separate battery companies simply finding a new B2B market is to miss the entire strategic picture.

This is a deliberate, state-guided industrial strategy. From a Seoul insider’s perspective, the objective is to create a fully integrated, vertically-aligned export ecosystem that is nearly impossible for competitors to replicate.

The ultimate sales pitch is no longer just a world-class K2 tank or K9 howitzer. The pitch is a total system. A foreign nation that buys into K-Defense is now buying into an ecosystem where the same Korean chaebols provide the platforms (Hyundai Rotem), the artillery (Hanwha), the submarines (Hanwha Ocean), and the advanced Samsung, LG, or SK batteries that power them all.

This integration of K-Tech and K-Defense is the new, unassailable competitive advantage.

Hi, I’m [jeybee]. As a long-time resident of Seoul, I’m passionate about uncovering the authentic, everyday magic of Korea. This blog is my way of sharing my favorite spots, tips, and cultural insights with you, beyond the usual tourist traps.