Investing in South Korea for Americans

As a US investor, you’ve likely built a solid portfolio on the back of American giants like Apple, Amazon, and the S&P 500. But in today’s interconnected world, looking beyond our borders for growth isn’t just an option; it’s a strategic necessity. One of the most dynamic and technologically advanced markets to capture investors’ attention is South Korea.

You’ve seen their brands everywhere—from the Samsung phone in your pocket to the Hyundai in your driveway. This has probably led you to a critical question: is South Korea a good place to invest for an American in 2026?

The answer isn’t a simple yes or no. It’s a nuanced “it depends on your goals and risk tolerance.” From my experience helping investors navigate new markets, the key is to understand both the glittering opportunities and the underlying risks. This guide will give you a balanced, no-jargon breakdown and a clear, step-by-step plan to get started.

The Bull vs. Bear Case: Should You Invest in South Korea?

Every smart investment decision begins with weighing the good against the bad. South Korea is a classic “high-potential, specific-risk” market. Here’s a clear look at the arguments for (the bull case) and against (the bear case).

| The Bull Case (Why You Should Invest) |

The Bear Case (Reasons for Caution)

|

|

| ✅ Technological Powerhouse: South Korea is a global leader in high-growth industries like semiconductors, 5G, electric vehicle batteries, and AI hardware. |

❌ Geopolitical Risk: The persistent tension with North Korea is a unique and unpredictable risk that hangs over the market.

|

|

| ✅ World-Class Global Brands: You’re investing in a market home to dominant international companies like Samsung, Hyundai, LG, and SK Hynix. |

❌ Corporate Governance Concerns: The market is dominated by “chaebols” (large, family-controlled conglomerates). This can sometimes lead to governance practices that don’t favor minority shareholders.

|

|

| ✅ Strong, Export-Driven Economy: The nation consistently proves its resilience and ability to compete on the global stage, exporting high-value goods worldwide. |

❌ Demographic Headwinds: South Korea has one of the world’s fastest-aging populations and lowest birth rates, posing long-term challenges to economic growth and domestic consumption.

|

Korean Stock Market Outlook 2026: What to Expect

Looking ahead, the Korean stock market outlook 2026 appears cautiously optimistic, driven by a global recovery in key sectors. Major financial institutions like the OECD and the IMF project South Korea’s GDP growth to be in the range of 1.8% to 2.2% for 2026.

This growth is expected to be fueled by two main engines:

- A Resurgence in Semiconductor Exports: The global demand for advanced chips, essential for everything from data centers to the AI revolution, directly benefits Korean giants like Samsung and SK Hynix.

- Recovering Domestic Demand: As inflation stabilizes and economic activity picks up, consumer spending within Korea is expected to strengthen.

For an investor, this means the core industries that make up the Korean market are well-positioned to capitalize on some of the biggest global trends over the next few years.

How to Start Investing in South Korea from the USA 3-Step Guide

Feeling intimidated about buying international stocks? Don’t be. From my years of experience, I can tell you it’s gotten remarkably simple. Here’s how you can get exposure to the South Korean market without leaving your desk.

Step 1: Choose Your Strategy: ETFs vs. Individual Stocks

For 99% of beginners in international investing, the choice is clear: start with an Exchange-Traded Fund (ETF).

- ETFs (Recommended): An ETF is a single fund that holds a basket of stocks. By buying one share of a South Korea ETF, you instantly own a small piece of dozens of the country’s top companies. It provides instant diversification and dramatically lowers your risk compared to picking one or two stocks.

- Individual Stocks: Buying individual foreign stocks can be complex due to different regulations and currency issues. While some Korean companies are listed on US exchanges (more on that below), it’s a more advanced strategy.

Step 2: Select a Brokerage Account

The good news is you probably don’t need a new account. Major US brokerages make it easy to buy international ETFs. If you have an account with any of the following, you’re ready to go:

- Fidelity

- Charles Schwab

- Vanguard

- ETRADE

Step 3: Research and Invest

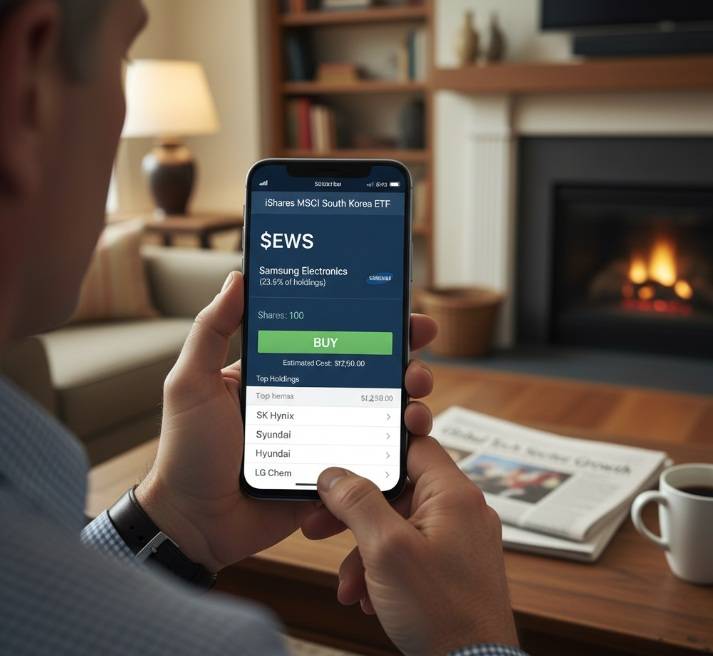

Once you’re logged into your brokerage account, the process is the same as buying a US stock.

- Use the “Trade” or “Research” function.

- Enter the stock ticker symbol for the ETF you want to buy (we’ll cover the top ones next).

- Choose the number of shares you want to purchase and place your order.

It’s that straightforward. You are now an international investor.

Best South Korean ETFs for US Investors

This is the most critical part of your journey. Choosing the right ETF is your gateway to the market. Here are two of the most popular and accessible options for Americans.

iShares MSCI South Korea ETF (EWY)

This is the largest and most well-known ETF for South Korea. It aims to track the MSCI Korea 25/50 Index, giving you exposure to a wide range of large and mid-sized Korean companies. Because the index is market-cap weighted, it is heavily concentrated in its largest holding. As of late 2025, a look inside the EWY portfolio reveals that Samsung Electronics makes up a staggering ~23% of its assets. If you want a big bet on Korea’s biggest players, this is your ETF.

Franklin FTSE South Korea ETF (FLKR)

This is another excellent option that often comes with a lower expense ratio (meaning it costs you less to own). It tracks a similar, but slightly different, index—the FTSE South Korea Capped Index. It provides broad exposure just like EWY and is a fantastic choice for cost-conscious investors looking to capture the performance of the overall Korean market.

How to Buy Samsung Stock from US Investors

This is one of the most common questions I get. Investors see Samsung’s global dominance and want to own a piece of it directly. However, for most US retail investors, buying individual shares of Samsung Electronics (which trades on the Korea Exchange) is difficult and impractical.

The simple, powerful solution is to use the ETFs mentioned above.

By purchasing the iShares MSCI South Korea ETF (EWY), you are effectively making a significant investment in Samsung. With the company representing nearly a quarter of the entire fund, the performance of EWY is heavily tied to the success of Samsung. It’s the most efficient way for an American to “buy Samsung stock.”

The Exception: Directly-Listed Korean Companies Like Coupang

There is one major exception to the rule: some Korean companies have chosen to list their shares directly on a US stock exchange. The most prominent example is investing in Coupang stock (CPNG).

Coupang, often called the “Amazon of South Korea,” is listed on the New York Stock Exchange (NYSE). This means you can buy and sell shares of CPNG in your Fidelity or Schwab account just as easily as you would buy shares of Apple (AAPL) or Microsoft (MSFT). For these specific US-listed companies, you don’t need to worry about ETFs or foreign exchanges.

Conclusion: The Verdict for US Investors

So, let’s circle back to our original question: is South Korea a good place to invest in 2026?

For the American investor looking to diversify their portfolio with targeted exposure to a technologically advanced, export-driven economy, South Korea presents a compelling, high-growth opportunity. The nation’s leadership in future-facing industries like semiconductors and AI hardware is undeniable.

However, this opportunity comes with a unique set of risks—geopolitical tensions, corporate governance quirks, and long-term demographic pressures—that you cannot ignore.

The most prudent approach for a beginner is to start small and use a diversified, low-cost ETF like EWY or FLKR. This allows you to participate in the market’s upside while mitigating the risk of having all your eggs in one or two corporate baskets. It’s your one-click ticket to investing in the South Korean economic engine.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or tax advice. You should consult with a licensed professional before making any investment decisions. The author is not a financial advisor and the views expressed are for informational purposes only.

Frequently Asked Questions (FAQ)

Q1: What are the main risks of investing in the South Korean market?

The three primary risks are: 1) Geopolitical tension with North Korea, which can cause market volatility. 2) Corporate governance issues related to the dominance of family-controlled conglomerates (chaebols). 3) Long-term demographic challenges from an aging population and low birth rate, which could impact future growth.

Q2: Do I need to worry about currency exchange rates when buying a South Korean ETF in the US?

Yes and no. You purchase the ETF shares in US dollars (USD), so you don’t have to perform any currency conversion yourself. However, the underlying value of the Korean stocks held by the ETF is in the South Korean Won (KRW). Therefore, if the Won weakens against the Dollar, it can negatively impact your investment returns, and vice versa. This currency risk is inherent in most international investing.

Q3: How are my earnings from a South Korean ETF taxed in the US?

They are taxed just like any other US-based stock or ETF. If you sell the ETF for a profit after holding it for more than a year, it’s typically taxed at the lower long-term capital gains rate. Dividends paid out by the fund are taxed as qualified or ordinary dividends, depending on the holding period. You will receive a standard 1099 form from your brokerage.

The South Korea Investment Toolkit for US Investors.pdf

Hi, I’m [jeybee]. As a long-time resident of Seoul, I’m passionate about uncovering the authentic, everyday magic of Korea. This blog is my way of sharing my favorite spots, tips, and cultural insights with you, beyond the usual tourist traps.