Introduction: How to Open an Online Brokerage Account

So, you’ve decided to start investing. That’s an amazing first step toward building your financial future! But if you’re anything like I was when I started, that initial excitement is probably mixed with a little bit of anxiety. The world of investing can feel like an exclusive club with its own secret language.

Let me tell you a secret: it’s not as complicated as it looks. The single most important step you can take right now is opening the right account. This guide is designed to be your friendly co-pilot, walking you through exactly how to open an online brokerage account for beginners. We’ll skip the confusing jargon and focus on a simple, 4-step process that will take you from uncertain to empowered. You can do this.

Why You Need a Brokerage Account to Start Investing

Before we dive in, let’s quickly cover what a brokerage account actually is.

Think of it like a special kind of bank account. Instead of just holding cash, a brokerage account allows you to buy, sell, and hold investments like stocks, bonds, and funds. It’s your personal gateway to the stock market. You can’t just buy a share of Apple from your regular checking account; you need a brokerage account to do it.

Step 1: Understand Your Goals & Options

The first decision you need to make is about how hands-on you want to be with your investments. This choice will guide you to the right type of account.

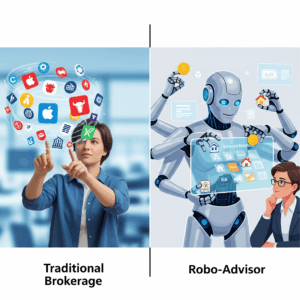

Robo-Advisor vs. Traditional Brokerage: What’s the Difference?

- Traditional Brokerage: This is the “Do-It-Yourself” (DIY) option. You are in the driver’s seat. You choose exactly which stocks, ETFs, or other investments you want to buy and sell. This path offers the most control and is perfect for those who are curious and want to learn by doing. Platforms like Fidelity and Charles Schwab are great examples.

- Robo-Advisor: This is the “Do-It-For-Me” option. A robo-advisor uses a computer algorithm to build and manage a diversified investment portfolio for you based on your goals and risk tolerance. You simply answer a few questions, and it does the rest. This is an excellent choice if you feel overwhelmed and just want to get started with a professionally managed portfolio. Platforms like Betterment and Wealthfront are leaders in this space.

My Advice for Beginners: If you’re nervous, a robo-advisor is a fantastic way to start. However, most traditional brokerage platforms now offer features that make DIY investing easier than ever, giving you more room to grow as you learn. For this guide, we’ll focus on traditional brokerages because they offer the most flexibility.

Step 2: Compare the Best Online Brokerage Accounts for Beginners

Choosing a brokerage is like choosing a new bank—you want one that’s reputable, secure, and has low fees. The great news is that competition has forced most major brokers to offer $0 commission trades on stocks and ETFs, which is a huge win for new investors.

Here’s a quick comparison of three of the most trusted and beginner-friendly platforms:

Each of these platforms offers some of the best stock trading apps for beginners, so you can manage your investments easily from your phone. You truly can’t go wrong with any of them. My personal experience started with Fidelity because their fractional shares feature let me dip my toes in with just a few dollars, which felt much less intimidating.

Is It Safe to Open an Online Brokerage Account? (Yes, Here’s Why)

This is one of the most common and important questions beginners ask. It’s your hard-earned money, and you want to know it’s protected.

The answer is a resounding yes, it is safe, provided you choose a reputable broker like the ones listed above. Here’s the key reason: SIPC Insurance.

All legitimate U.S. brokerage firms are members of the Securities Investor Protection Corporation (SIPC). SIPC protects the securities and cash in your account for up to $500,000 in the extremely unlikely event that the brokerage firm fails. This is not protection against market losses (investing always has risks), but it is protection against the firm itself going out of business. It’s the investing world’s equivalent of FDIC insurance for bank accounts.

Understanding Brokerage Fees and Commissions

Fees can eat into your investment returns, so it’s crucial to understand them. Thankfully, things have gotten much simpler for beginners.

- Commissions: This is a fee you pay to the broker for executing a trade (buying or selling). As mentioned, most major brokers now offer $0 commissions for online stock and ETF trades. This is the new industry standard.

- Expense Ratios: This fee applies to mutual funds and ETFs, not the brokerage account itself. It’s the annual cost of running the fund, expressed as a percentage. When you start investing in funds, always look for low expense ratios (under 0.20% is considered very good).

- Account Fees: Most online brokers have eliminated annual maintenance or inactivity fees, especially for standard accounts.

The bottom line: for a beginner buying simple stocks or ETFs on a major platform, your direct costs should be close to zero.

Step 3: What You’ll Need to Open Your Account (The Checklist)

The application process itself is surprisingly fast—often taking less than 15 minutes. It’s just like opening a bank account online. To make it smooth, have this information ready:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- U.S. residential address

- Your employer’s name and address (This is a standard regulatory requirement)

- Your bank account information (routing and account number) to link for funding

Step 4: Funding Your Account & Getting Started

Once your application is approved (which is often instant or within a day), the final step is to move money into your new brokerage account.

This is usually done via an electronic transfer (ACH) from your linked bank account. You can decide how much you want to start with. Thanks to no-minimum accounts, you can truly get started with any amount you’re comfortable with. This is how to start investing with little money—you don’t need thousands of dollars. Even $50 or $100 is a fantastic start.

Once the funds are in your account, you’re ready to make your first investment. Congratulations!

Conclusion: You Are Ready to Begin

Opening an online brokerage account might have seemed like a monumental task just 10 minutes ago, but now you know it’s just a series of simple, clear steps. You know the difference between account types, you understand the costs (or lack thereof), you know your money is protected, and you have a checklist of everything you need.

You have done the research. You are prepared. The only thing left to do is take that first step. Don’t let the fear of not knowing everything stop you from starting. The journey to building wealth starts with this one, simple action. You’ve got this.

Frequently Asked Questions (FAQ)

What is the absolute minimum amount of money I need to start investing?

For most major online brokerage accounts like Fidelity and Charles Schwab, there is no minimum deposit required. You can literally open an account with $0 and fund it with as little as $1. Thanks to fractional shares, you can start buying pieces of stocks with just a few dollars.

What should I invest in first as a beginner?

A fantastic starting point for most beginners is a low-cost, broad-market index fund ETF, such as one that tracks the S&P 500 (examples include VOO or IVV). This single investment instantly diversifies your money across 500 of the largest U.S. companies, making it a simple and effective way to begin.

Can I lose more money than I initially invest?

For a beginner who is simply buying stocks, ETFs, or mutual funds, the answer is no. The maximum amount you can lose is the total amount you have invested. You can only lose more than your initial investment if you use complex strategies like short selling or trading on margin, which are not recommended for beginners and often require special permissions. Stick to the basics, and your downside is limited to your investment.

Hi, I’m [jeybee]. As a long-time resident of Seoul, I’m passionate about uncovering the authentic, everyday magic of Korea. This blog is my way of sharing my favorite spots, tips, and cultural insights with you, beyond the usual tourist traps.