Goodwill Letter for Late Payment..

It’s incredibly frustrating. You’ve worked hard to build a good credit history, paying your bills on time month after month. Then, one mistake—a single late payment—leaves a black mark on your credit report for up to seven years, potentially dragging down your score and costing you money on future loans. If this sounds familiar, you’re not alone, and there’s a powerful tool you might not know about: the goodwill letter for late payment.

This guide will walk you through everything you need to know about asking a creditor for a “goodwill adjustment.” We’ll cover when these letters are most effective, how to write a persuasive request, and provide copy-and-paste templates to get you started. Let’s take the first step toward cleaning up that credit report.

When is a Goodwill Letter Most Effective?

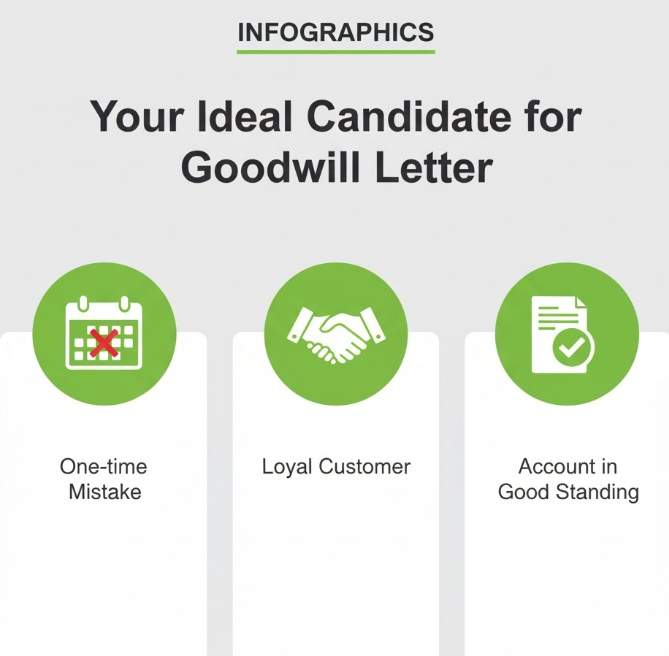

A goodwill letter is not a magic wand; its success depends heavily on your history with the creditor. It’s a request for forgiveness, not a demand. Lenders are most likely to consider your request if you fit a certain profile.

You have the highest chance of success if:

- You have a long-standing, positive history. You’ve been a loyal customer for years with a consistent track record of on-time payments.

- The late payment was a one-time event. This isn’t a strategy for someone who is frequently late. This is for the rare slip-up.

- Your account is now current. You must have caught up on the missed payment and are currently in good standing with the creditor.

- You had a valid, temporary reason. While not always necessary, having a legitimate reason for the lapse (e.g., hospitalization, job loss, chaotic move) can strengthen your case.

For example, a loyal customer of five years who made their first-ever late payment during a hectic cross-country move has a very strong case. A goodwill letter acknowledging the situation can be very persuasive because it shows the delinquency was an exception, not the rule.

How to Ask for a Goodwill Credit Adjustment

How you frame your request is crucial. Your goal is to be humble, respectful, and persuasive. Think of it as a professional appeal to a person on the other side, not a dispute with a faceless company.

Here are the key tips for writing your letter:

- Be Polite and Respectful: Always maintain a courteous and professional tone. Remember, you are asking for a favor. Phrases like “I would be grateful if you would consider…” go a long way.

- Take Responsibility: Acknowledge the late payment upfront. Don’t make excuses, but briefly and honestly explain the circumstances if there was a specific hardship. This shows maturity and accountability.

- Keep it Brief and to the Point: The person reading your letter is busy. Get straight to the point in a few short paragraphs. Clearly state who you are (name, account number), what happened, and what you are asking for.

- Emphasize Your Loyalty: Remind them of your positive history as a customer. Mention how long you’ve been with them and your excellent payment record (aside from this one instance).

- Clearly State Your Request: Don’t be vague. Explicitly ask for the removal of the late payment entry from your credit reports sent to all three major bureaus (Equifax, Experian, and TransUnion).

Sample Goodwill Letter to Remove Late Payments

Here are two distinct templates you can adapt to your situation. Be sure to replace the bracketed information with your own personal details.

Template 1: For a Simple Oversight or Mistake

[Your Name] [Your Address] [Your City, State, Zip Code] [Your Account Number]

[Date]

[Creditor Name] [Creditor’s Mailing Address]

Subject: Request for Goodwill Adjustment for Account #[Your Account Number]

Dear [Creditor Name or “Sir/Madam”],

I am writing to you today regarding a late payment reported on my account for [Month, Year]. I have been a loyal customer for [Number] years and I pride myself on maintaining a perfect payment history.

Unfortunately, due to a simple oversight, I missed the payment due on [Date of Missed Payment]. I take full responsibility for this mistake and can assure you that I have taken steps to ensure it will not happen again. As you can see from my records, this is an isolated incident in an otherwise spotless payment history.

This single late payment has lowered my credit score, and I am kindly requesting your consideration for its removal from my credit reports with TransUnion, Equifax, and Experian. I would be incredibly grateful for this “goodwill adjustment” as a reflection of my long-standing and positive relationship with your company.

Thank you for your time and consideration.

Sincerely, [Your Signature] [Your Printed Name]

Template 2: For a Resolved Hardship

[Your Name] [Your Address] [Your City, State, Zip Code] [Your Account Number]

[Date]

[Creditor Name] [Creditor’s Mailing Address]

Subject: Goodwill Adjustment Request for Account #[Your Account Number]

Dear [Creditor Name or “Sir/Madam”],

I am writing to humbly request the removal of a late payment reported on my account for the period of [Month, Year]. I have been a dedicated customer since [Year], and I truly value my relationship with your company.

During that time, I experienced a [Briefly and honestly describe the hardship, e.g., “serious medical emergency in my family,” “sudden job loss,” “technical issue with my bank’s auto-pay service”]. This unexpected situation unfortunately led to me overlooking my payment due on [Date of Missed Payment].

I am happy to report that the situation has been fully resolved, and my finances are stable again. My account is currently up-to-date, and I want to assure you of my commitment to making all future payments on time. My payment history, apart from this single incident, reflects that commitment.

Because of my long and positive history as a customer, I would be deeply appreciative if you would consider making a goodwill adjustment to remove late payments from my credit report with all three credit bureaus. This would greatly help me as I work to maintain my financial health.

Thank you for your understanding and for considering my request.

Sincerely, [Your Signature] [Your Printed Name]

What to Do After You Send Your Letter

Once you’ve mailed your letter (sending it via certified mail with a return receipt is a good idea for proof of delivery), the waiting game begins.

- Be Patient: It can take 30-60 days to get a response or see a change. Creditors have internal processes for these requests.

- Monitor Your Credit: This is the most important step. After a few weeks, start checking your credit reports to see if the negative mark has been removed. A change in your credit report is the best confirmation that your request was successful.

- Use a Credit Monitoring Service: Staying on top of your credit report is crucial. Services like Experian Boost™ or Credit Karma provide free and easy access to your credit reports and scores. They will alert you to any changes, so you’ll know immediately if your goodwill letter worked.

If you don’t hear back or see a change after 60 days, you can consider sending a follow-up letter or calling the customer service department.

Conclusion

A single late payment shouldn’t define your financial future. By writing a polite, honest, and professional goodwill letter, you empower yourself to take control of your credit history. The process is straightforward: Write your letter using one of the templates, Send it to the correct address, and Monitor your credit report for changes.

Success isn’t guaranteed, but for a loyal customer who made an honest mistake, it’s a strategy with a real chance of success. You have nothing to lose and a better credit score to gain.

Frequently Asked Questions (FAQ)

Do goodwill letters actually work?

Yes, do goodwill letters actually work for many people, but success is not guaranteed. It depends entirely on the creditor’s internal policies and your specific situation. Having a strong history of on-time payments significantly increases your chances.

Where do I find the right address to mail my letter?

The best address is often the general correspondence address listed on your monthly statement. If you can’t find it there, check the creditor’s official website for a “Contact Us” or “Mailing Address” section. Avoid sending it to the payment processing address.

How long should I wait for a response before following up?

Give the creditor at least 30 to 45 days to process your request and update the credit bureaus. If you haven’t received a response or seen a change on your credit report after 60 days, it is reasonable to make a follow-up phone call or send a second letter.

What are my other options to remove late payments from my credit report if this doesn’t work?

If a goodwill letter fails, your options are limited for a legitimate late payment. You can file a dispute with the credit bureaus ONLY if the information is inaccurate. For accounts in collections, you might negotiate a “pay-for-delete.” Otherwise, the only option is to wait for the late payment to age off your report after seven years while continuing to build a positive history of on-time payments.

Hi, I’m [jeybee]. As a long-time resident of Seoul, I’m passionate about uncovering the authentic, everyday magic of Korea. This blog is my way of sharing my favorite spots, tips, and cultural insights with you, beyond the usual tourist traps.